How Income Inequality Is Killing Social Security

The wage gap is bankrupting the system workers rely on

The real destroyer of Social Security isn’t actually Trump, Elon or anyone in the MAGA camp. It’s income inequality.

If you’re like me, you’ve paid Social Security taxes on every penny you’ve ever earned. But if you earn more than $176,100 in a year, you get a big break. As soon as you cross that income threshold, you get to stop contributing to Social Security. That means some people stop paying into the system halfway through the year. Some of you are already done.

Worker wages have stagnated

From 1979 to 2025, worker productivity rose by 86 percent, while hourly pay only rose 32 percent. That gap — the value workers create vs. what they’re paid — does not trickle down. Instead, it gets funneled to the top. And as a result, more money is flowing into CEO compensation and stock buybacks than into Social Security.

In 1965, the average CEO made 21 times what their average employee made. Today? It’s 290 times as much.

Why do I say this is killing Social Security?

Let’s break it down with some simple math, since as a journalism major and English minor that’s the only kind I can do.

Let’s say a company pays $2 million in total salaries each year.

Scenario 1:

The CEO earns $1 million. Ten employees each earn $100,000.

Each worker pays 6.2 percent into Social Security: $6,200

The company matches that amount: $6,200

Total per worker: $12,400 × 10 workers = $124,000

Now look at what the CEO pays. Remember, Social Security taxes only apply to the first $176,100 of income.

6.2 percent of $176,100 = $10,918.20

Matched by employer: $10,918.20

Total from CEO pay: $21,836.40

Total amount flowing into Social Security coffers: $124,000 + $21,836.40 = $145,836.40.

Scenario 2:

The company pays out $2 million total in salaries — but this time, the CEO gets $1.5 million and the 10 employees are each paid only $50,000.

Each worker now pays 6.2 percent of $50K = $3,100

Employer matches: $3,100

Total per worker: $6,200 × 10 workers = $62,000

CEO’s Social Security tax? Still only on the first $176,100.

Same total from CEO: $21,836.40

New total contribution to Social Security coffers: $62,000 + $21,866.40 = $83,866.40

That’s $61,970 less, even though the company’s total salary expenses haven’t changed.

This isn’t just about fairness

Now imagine this playing out across the economy, over and over again, in company after company. Wages for workers stagnate, CEO pay soars and Social Security gets weaker every year. That’s what is happening.

And it gets worse.

A worker earning $100K might be able to fully fund a 401(k) and build a secure retirement. A worker making $50K — especially one supporting a family or living in a high-cost area — may not be able to save anything at all. Such a worker will depend on Social Security in old age.

Then there’s the rise of gig work. Many workers today are classified as independent contractors — think Uber drivers, freelancers, even Substack writers. If you're self-employed, you pay both sides of the Social Security tax — 12.4 percent. And if your income is modest, that tax can cut into your ability to survive.

Social Security won’t survive this trend

Neither will workers.

If we keep allowing inequality to grow, the system breaks. Concentrated wealth starves collective safety nets.

And the country’s wealthiest people are knowingly letting it happen.

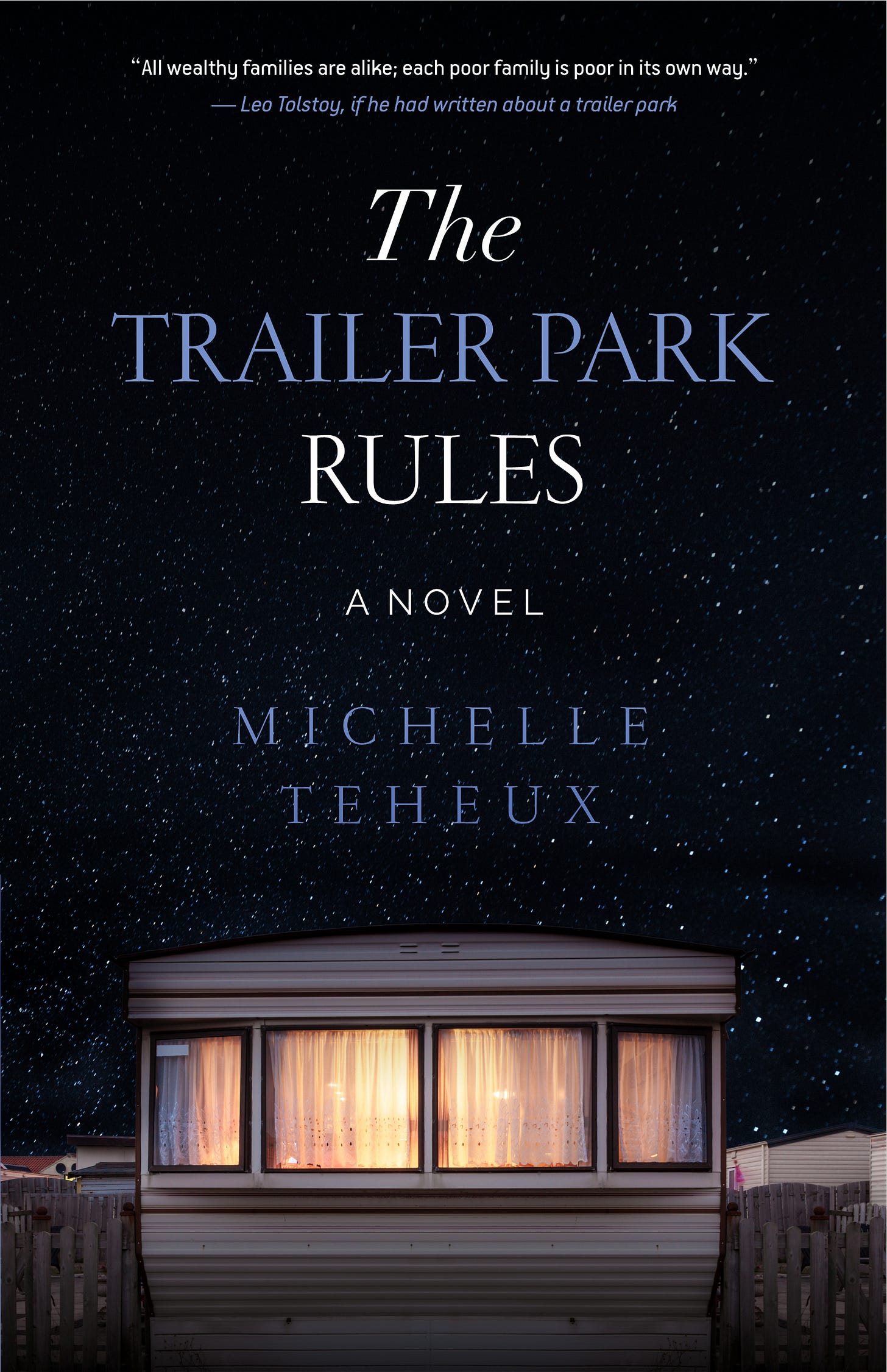

About Michelle Teheux

I’m a writer in central Illinois. If you like my work, subscribe to me here and on Medium. I also have a new Substack aimed at authors who want to self-publish books, called The Indie Author. My most recent book is Strapped: Fighting for the soul of the American working class. My most recent novel is The Trailer Park Rules. If you prefer to give a one-time tip, I accept Ko-fi.

All wealthy families are alike; each poor family is poor in its own way.

— Leo Tolstoy, if he had written about a trailer park

For residents of the Loire Mobile Home Park, surviving means understanding which rules to follow and which to break. Each has landed in the trailer park for wildly different reasons.

Jonesy is a failed journalist with one dream left. Angel is the kind of irresponsible single mother society just shakes its head about, and her daughter Maya is the kid everybody overlooks. Jimmy and Janiece Jackson wanted to be the first in their families to achieve the American dream, but all the positive attitude in the world can’t solve their predicament. Darren is a disabled man trying to enjoy his life despite a dark past. Kaitlin is a former stripper with a sugar daddy, while Shirley is an older lady who has come down in the world and lives in denial. Nancy runs the park like a tyrant but finds out when a larger corporation takes over that she’s not different from the residents.

When the new owners jack up the lot rent, the lives of everyone in the park shift dramatically and in some cases tragically.

Welcome to the Loire Mobile Home Park! Please observe all rules.

The 1% aren’t just letting Social Security fail, they’re making it happen. They’ve been trying to kill it from day one.

Thank you both for the math and the clarity!