A house in my neighborhood, I am told, just sold for $43,000.

It’s been sitting empty for a couple years, so I knew somebody would get a good deal.

In an April 2 Note, I posted the information about the house and guessed off the top of my head that someone could get it for $40K. So I wasn’t far off.

Zillow estimated its value at $156,100, which I’d say is about right. It was listed at $170K last year. It has three bedrooms, two full baths and 1,692 square feet, a decent-sized yard and a garage.

This is one housing solution

You have to be willing to perform some sweat equity sometimes, but honestly, if you find the right deal you could still be money ahead even if you hired contractors to do the work. I wish I had found an opportunity like this when I was much younger. This deal probably put about $100,000 in the buyer’s pocket.

I know others who have purchased duplexes or small apartment complexes and lived in one unit and rented out the other(s). You have to have enough money to afford a sizable down payment to make that work, which I never did.

I bought my first house in 1990

My daughter was a baby. I hadn’t had my son yet. My first husband and I paid $37,500 for a charming 1925 Arts and Crafts house in an iffy neighborhood. The house payment was about what our rent had been, and we put down a pittance thanks to FHA.

I’m very thankful for that initial purchase. My life would be dramatically different today if I had not gotten a rung on the home ownership ladder when I did. I’ve owned four houses in my lifetime, and all of them rested on the foundation of the equity I got from that little house.

I paid 9.5 percent interest, by the way, and everybody thought that was excellent!

Sometimes a first-time home buyer can get a deal on the down payment. One of my relatives got a down payment loan from her municipality. Because she lived there for five years, the “loan” was forgiven. It’s always worth checking to see if you qualify for something like that.

Good debt, bad debt

If I had followed the advice of some financial gurus, I’d still be renting today. Supposedly, you need to save up some enormous amount of money before buying a house. I’m sure glad I ignored that advice. I was going to be paying about $400 for a place to live either way, so why not build equity?

Of course, when the furnace went out the following winter, that was our problem, not a landlord’s, and we paid an exorbitant amount of interest on the furnace loan.

But that was the only major emergency issue we faced in the time we lived there. Everything else we did were optional improvements we did ourselves. (I’ll tell you one thing: Never again will I ever paint a two-story house myself. But I was young then, and you’d be surprised how much you can get done while a toddler naps.)

I’m about to pay my house off

It’s so close that this month I paid a grand total of $8.76 in interest! I look it up online every month and chortle with glee.

This is in stark contrast to the agony I used to feel when I’d look at my mortgage statements (pre-internet) and feel like choking at the tiny principal payments and out-size interest payments. The first month you see the principal payment exceed the interest payment, you feel a shift somewhere deep in your financial soul and it feels so, so good. I’ve never used heroin, but I can only imagine the euphoria must be similar.

People talk about the punishing costs of home maintenance, especially for an old house like mine, and it’s all true. We’ve done a lot to this house, and we still have more to do. You will eventually have to shell out for a new roof, which we’ve done, and plenty of smaller things.

Shit happens and will always happen

But soon we’ll only have to worry about property taxes, insurance and upkeep. Those costs aren’t nothing, but never will I ever have a landlord tell me my rent is going to jump. Zillow claims my house would rent for $1,500 per month. That makes my eyeballs pop. I’ve never in my life paid anything close to that for rent or mortgage.

Such a cost is considered normal to everyone else, but it seems outrageous to me, a writer who has never made much money.

Everybody wants to live alone now

Throughout most of history, people lived communally to some degree. Young people did not move to their own private cave, and building a new structure for every young adult was never the norm.

Modern American culture celebrates the ideal of leaving the parental nest just as soon as possible. The number of people living alone has more than doubled since 1960, according to this good read from the Population Reference Bureau.

Most people do not want to live with anyone but their partner and children if they have them; it’s unusual for single people to choose to have roommates if they can afford not to.

Heck, a lot of single people today declare they don’t want to live with anyone at all. And it’s becoming increasingly common for apparently happily married couples to have their own bedrooms.

People like their privacy.

But living alone is expensive

Nobody else is chipping in on the rent and utilities. That’s obvious, but there’s another factor: It takes a lot more resources to provide a dwelling for every adult.

When people live in a group, there is an economy of scale. My family of four, when my kids lived at home, required one vacuum cleaner, one lawn mower, one set of dishes, one set of pots and pans, one set of tools. One internet provider. One furnace. You get it.

Now? My daughter (who has two children) and my son (who is single and lives alone) have duplicates of pretty much everything. This includes big things, like washing machines, and all the small things you don’t really think about until you move out and suddenly need one, like bottle openers and nail clippers.

In my ideal world, I’d purchase a big piece of land out in the country where there would be a main house for my husband and me and auxiliary dwellings for my kids, plus extra cabins or tiny houses for all the writers/musicians/artists in residence I’d invite to join us. We’d have chickens, an apple orchard and a big communal garden. I’d have a huge kitchen where I’d prepare wonderful meals from scratch for everyone, because that’s my thing.

I don’t live in an ideal world, though.

Many years ago, as a newly divorced single mom in a suburban house that was bigger and more expensive than my single-mom budget could bear, I invited another newly single mother to move in with me. The idea was we could share expenses and have each other’s back with childcare. I thought it was a great idea, but she declined.

Side note: The other woman was from Ukraine; as far as I know she’s the only Ukrainian I have ever met. She sent her toddlers back to Ukraine to live with her parents for a couple of years rather than have to use daycare. I think about them often and hope they are safe.

That story, to me, illustrates how cultural influences shape living arrangements. I could not imagine sending my children to another country to live for a couple of years, particularly children young enough that they would not remember me. But to her, it felt like the best solution available.

My house is too big and I know it

Our nest is empty now, but my husband has a recording studio in the attic and doesn’t want to give that up until his hearing no longer allows him to mix. Plus, we’ve done a lot with this house, all of it to our personal tastes, not to the tastes of the future buyer. So moving isn’t in our short-term plans.

I’ve thought about the possibility of a roommate, but I know that choice is fraught with complications. I’ve been a landlord and tenants can be bad enough when they’re not right under your roof.

I probably don’t want to share a kitchen with others unless I have to.

NIMBY doesn’t help

One of the reasons housing is so unaffordable in some areas is that people who have single-family houses do not want big multi-family apartment buildings near them. But one lot with many apartments uses a lot fewer resources to build — not to mention eating up much less ground. Apartments are very practical for many lifestyles, especially for anyone who doesn’t want to spend time mowing the yard or weeding a garden.

Even though I live in a single-family home, I recognize the downsides. Houses are much more wasteful than apartments, for one thing.

This isn’t an issue where I live, because existing housing is relatively plentiful and inexpensive. My house dates to 1897. Would I have built this house today? No. It would be insanely wasteful, but since it already exists, it would be even more wasteful to tear it down and start new.

Meanwhile, despite all the talk about insufficient housing, there are still many towns with numerous inexpensive houses that nobody wants. People want newer houses with more up-to-date floor plans, and they want “better” neighborhoods that are built on former farmland.

But older houses don’t require new infrastructure because the roads, water, sewer, gas and electricity were installed decades ago. They do not require the use of new resources. Often, these older houses are solidly built with old-growth wood using traditional (and better) building techniques.

Moving into such a house seems to me a greener alternative to building, but some people crow about their low-carbon-footprint in brand-new showplaces with special green technologies that people like me can’t afford. I suppose that’s better than building a showplace that doesn’t contain any green tech.

Does it make sense to keep building big houses on large lots, eating up more and more farmland and woodland?

No. It really doesn’t. I could see it if these people wanted some space for a big garden, but that’s not what I usually see when I drive around. I see vast yards where the only “crop” is grass, and it’s kept a uniform green through fertilization, herbicide and irrigation. It’s an environmental disaster.

Can you work remotely?

Some people have to live in a big city for their job. But if you can do remote work, consider a smaller town where housing prices are still low. The owner class sees a downside to remote work — if you’re not paying a terrifyingly high mortgage near your job, you’re a bit harder to control.

Affordable housing is a form of freedom.

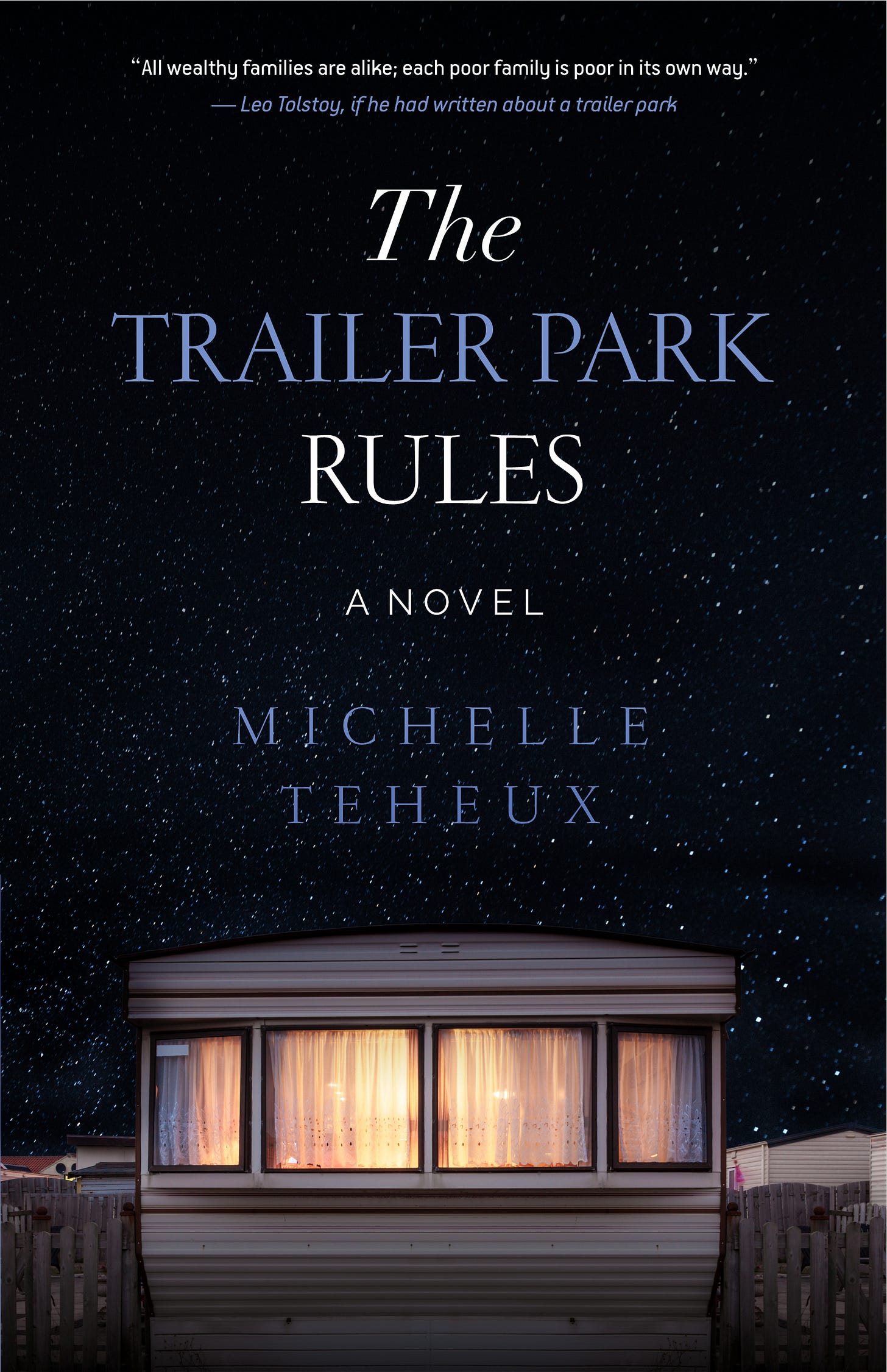

About Michelle Teheux

I’m a writer in central Illinois. If you like my work, subscribe to me here and on Medium. I also have a new Substack aimed at authors who want to self-publish books, called The Indie Author. My most recent book is Strapped: Fighting for the soul of the American working class. My most recent novel is The Trailer Park Rules. If you prefer to give a one-time tip, I accept Ko-fi.

All wealthy families are alike; each poor family is poor in its own way.

— Leo Tolstoy, if he had written about a trailer park

For residents of the Loire Mobile Home Park, surviving means understanding which rules to follow and which to break. Each has landed in the trailer park for wildly different reasons.

Jonesy is a failed journalist with one dream left. Angel is the kind of irresponsible single mother society just shakes its head about, and her daughter Maya is the kid everybody overlooks. Jimmy and Janiece Jackson wanted to be the first in their families to achieve the American dream, but all the positive attitude in the world can’t solve their predicament. Darren is a disabled man trying to enjoy his life despite a dark past. Kaitlin is a former stripper with a sugar daddy, while Shirley is an older lady who has come down in the world and lives in denial. Nancy runs the park like a tyrant but finds out when a larger corporation takes over that she’s not different from the residents.

When the new owners jack up the lot rent, the lives of everyone in the park shift dramatically and in some cases tragically.

Welcome to the Loire Mobile Home Park! Please observe all rules.

I became a homeowner at 40 after a decade of single motherhood, followed by marriage. I tried many times in the early 2000s to purchase a home on my nursing salary as a single mom - and with FHA availability - and yet I couldn’t afford anything that was not a fixer-upper — and spoiler alert: banks do not loan money for these types of homes that can’t pass inspection when you are buying your first home and don’t have enough cash upfront.

I also tried living with another single mom years before that — which was great in theory and terrible in reality. It turns out that we were excellent friends but terrible roommates. Our parenting styles clashed sometimes and we found other issues that made things untenable, so we called it quits after a few months.

I am all for the idea of buying older homes and also sharing space on the same property. Sadly, many people without lots of cash have an easier time getting a loan for a brand new home or new construction loan.

“Affordable housing is a form of freedom.”

I bought my first home in 1982 as an ensign, with a VA loan (no money down) for $45K, then sold it for $54K three years later when I got transferred. That was a big payout on a junior officer salary!

For 38 out of 45 years adulting I have been a home owner (or co-owner, the last 25) and I cannot imagine what the GenZ and Millennials are going through trying to get started.