The $649,000 Price Tag of Being Broke

How interest keeps the poor paying and the rich earning

Imagine you’re a young adult from a non-wealthy family.

You need to pay for college, a car, a place to live and perhaps to eventually raise a family, but you make entry-level wages. That means one thing:

Debt

How much will the average American pay in interest fees over their lifetime? It’s a shocker: $649,068, according to Self Financial Inc.

The poor stay poor because they are paying interest. The rich stay rich because they are always collecting it.

The payments eat up every spare dollar. Even if you delay having kids or are making a respectable beginning wage, you’re probably surprised at how little spending money you have.

You may think to yourself, “How am I struggling so much? I’ve done all the right things, and I’m making more money than I thought I would be at this point, and yet I can barely contemplate ordering a pizza some weeks. I’m broke.”

Why the poor buy cheap crap

Privileged people say you should buy quality goods and never have to replace them. Why buy a cheap new pressed board desk multiple times, they say, when for less money you can buy one high-quality solid wood desk you’ll have forever?

Why do you keep buying cheap tools when you could instead buy quality ones just once?

You know the answer to this.

It’s because you need a desk or a set of tools or whatever right now, and you can only manage to scrape up enough money to buy something cheap. Yes, you’d love to buy something higher in quality. But you already are not sure how you’re going to pay that unexpected dental bill.

The car is making a weird noise, too.

You regretfully walk past the nice desk and buy another shitty one. By the time this one breaks, you hope, maybe you can get a good one you’ll keep forever. But you can’t swing it now.

Think about all the cheap desks and beds and vacuums and tools you bought and then had to throw out and replace. Our landfills are full of such things. It wastes our money and our resources. It sucks for the environment. Nobody wants to keep buying cheap shit but what are we supposed to do?

If we could purchase quality goods the first time, we would.

We are not stupid. We are broke. Those are two different things.

How the rich skip the struggle phase

Is there anything more annoying than when a well-off person complains about poor people being irresponsible with their money?

Why would anybody get a rent-to-own washing machine? Don’t they know it’s a better deal to buy it outright? Why is that poor person not taking care of her teeth? She should be seeing her dentist every six months, like I do. And her teeth are so crooked. I think she’ll find she’s more employable if she gets her teeth straightened. My parents made sure mine were done. I guess her parents didn’t love her or something. And why is that dumb family still renting? They’re throwing their money away! They should have bought a house years ago. I swear, people are poor because they make one stupid choice after another.

Yeah. I’ve heard all these things. Some rich people honestly believe there’s no point in helping poor people because they’ll just blow the money anyway.

The situation often improves over time

As the years go by, you hopefully advance in your career and make more money. You pay off a lot of debt. Maybe you’re thrifty and you keep your vehicles long after you’ve finished paying for them, and that helps.

Maybe you decide not to rush into buying a bigger house as soon as you can manage it, so now your house payments feel more comfortable. Your children are in school all day, so your daycare expenses suddenly lift.

As if by magic, you suddenly have more money! Financial pressures ease and you put more money into your retirement account, or maybe you start funding it for the first time.

You can buy quality things. Life is looking better. If you’re not derailed by a divorce or medical bills or a job loss, you are finally getting to The Promised Land. And you dare to think that you might actually be able to retire someday after all.

You start paying attention to your investments. For the first time, you’re not paying much or anything in interest any more. In fact, to your amazement, you are making money! Your 401(k) is doing well. (Probably not at this exact moment in time, but I’m speaking generally.)

Where’s that money coming from?

This is a question we forget to ask.

Where exactly is that income on your investments, with which you plan to finance your retirement, coming from?

I am not an economist, and if you are, I hope you’ll leave a long, detailed comment about this. Tell me if I’m right or wrong. Perhaps I am a genius or a dumbass. I can’t wait to find out.

Some chunk of the money being earned by people in comfortable financial situations comes from the interest being paid by people in really uncomfortable financial situations.

Read this Wall Street Journal story about the man who made a fortune on the student loan system only to become upset at the cost of his grandchildren’s tuition.

Compound interest is the great divider

Compound interest is a powerful thing. It can ruin you financially if you’re paying it, and it can make you a fortune if you’re on the other end of it.

The poor often stay poor because they are always paying interest. It’s difficult to get ahead of it.

The rich often stay rich because they pay little or nothing in interest. Not only do they pay no interest, but interest other people pay flows into their coffers.

People in the middle class pay interest when they’re young and benefit from interest when they’re older.

Wealthy people can afford to pay for their children’s college education outright.

They may give a house or a huge down payment on one as a wedding or college graduation gift.

Ditto for the car.

The children of wealthy parents may pay little or no interest on anything they need.

The children of poor parents start out in the hole.

But sure, we live in the land of opportunity where everybody can achieve anything they want through hard work. (I love sarcasm.)

We could fix this system if we wanted

We won’t, of course, because it’s benefiting those in power. They are not going to voluntarily change this, because as far as they’re concerned, it’s working out great.

Therefore, we aren’t about to make higher education free or do anything meaningful to make buying one’s first house easier. (Some first-time homeowner programs exist, but they could go much further.)

There are a few things you might be able to do to cut that half-million-plus in interest.

I invited my son to live at home longer than he had planned. This allowed him to make triple and quadruple payments on his student loans and car, then save up an emergency fund. It gave him a much smoother launch into adulthood.

Some other ideas include:

Put off having children (or don’t have them at all)

Do without a car if you live in an area where that’s feasible

Have roommates for a few years

Buy second-hand furniture from thrift shops

Anything at all you can do to avoid paying ruinous interest while launching your life will help. The sooner you can stop putting interest into someone else’s pocket, the better off you will be later in your life.

Just imagine what you could do with an extra $649,068 in your pocket.

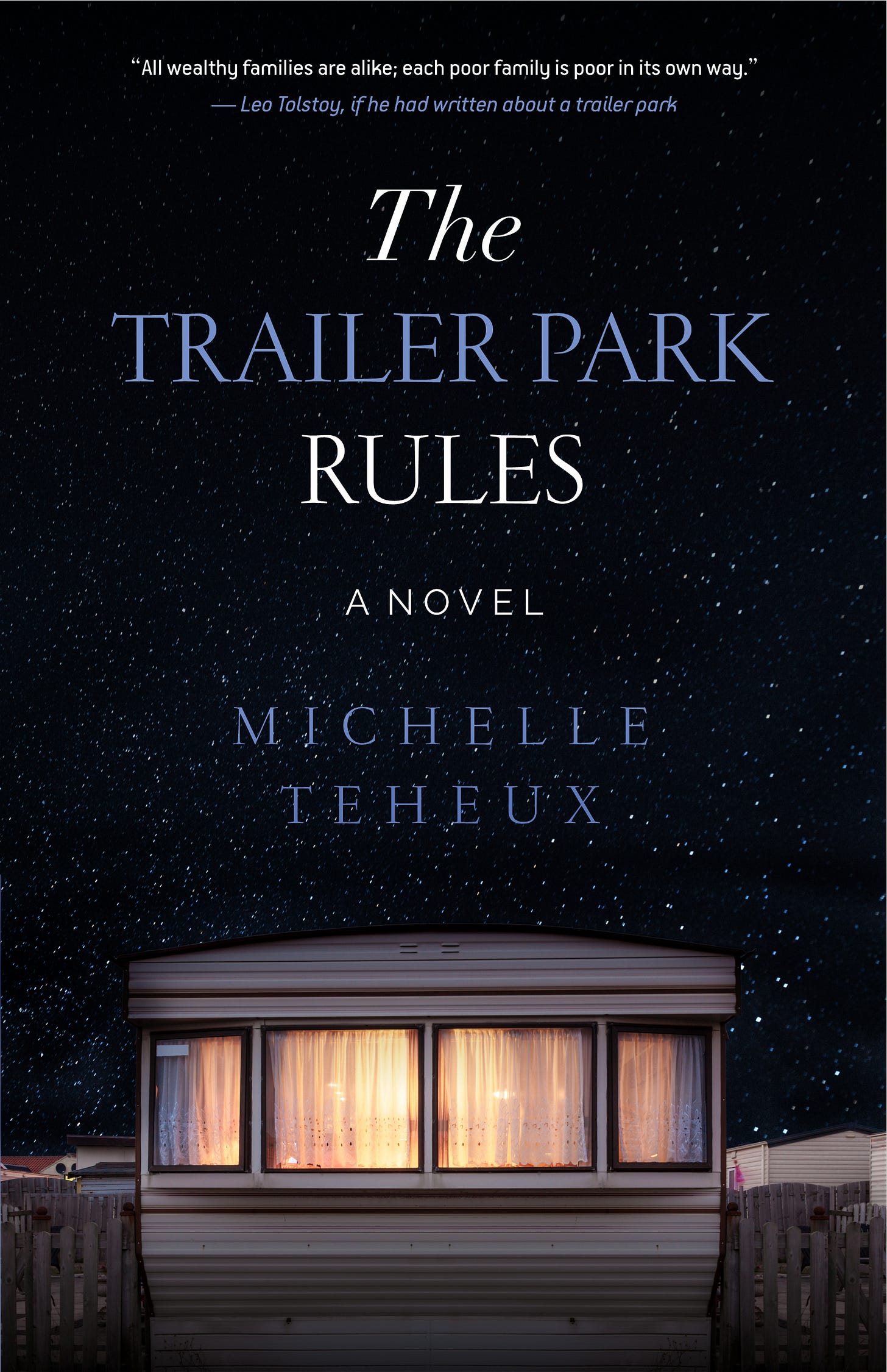

About Michelle Teheux

I’m a writer in central Illinois. If you like my work, subscribe to me here and on Medium. I also have a new Substack aimed at authors who want to self-publish books, called The Indie Author. My most recent book is Strapped: Fighting for the soul of the American working class. My most recent novel is The Trailer Park Rules. If you prefer to give a one-time tip, I accept Ko-fi.

All wealthy families are alike; each poor family is poor in its own way.

— Leo Tolstoy, if he had written about a trailer park

For residents of the Loire Mobile Home Park, surviving means understanding which rules to follow and which to break. Each has landed in the trailer park for wildly different reasons.

Jonesy is a failed journalist with one dream left. Angel is the kind of irresponsible single mother society just shakes its head about, and her daughter Maya is the kid everybody overlooks. Jimmy and Janiece Jackson wanted to be the first in their families to achieve the American dream, but all the positive attitude in the world can’t solve their predicament. Darren is a disabled man trying to enjoy his life despite a dark past. Kaitlin is a former stripper with a sugar daddy, while Shirley is an older lady who has come down in the world and lives in denial. Nancy runs the park like a tyrant but finds out when a larger corporation takes over that she’s not different from the residents.

When the new owners jack up the lot rent, the lives of everyone in the park shift dramatically and in some cases tragically.

Welcome to the Loire Mobile Home Park! Please observe all rules.

We are currently watching The Amazing Race tv show. There are a couple on there who are nurses. They want to win because their combined student loans are $400,000. Gobsmacked. They are in debt that much, so they can work at taking care of people. If they happen to win the Millions bucks, they’ll barely get to keep half of it.

So much has been made of the great wealth transfer as the Boomer generation leaves this earth but most of what I see is a greater wealth concentration and increased wealth inequality.

Financial advisors often have trouble convincing their clients it is okay to spend or even donate as they age. We spend our whole lives clutching on to money precisely because there is no sense of safety in our governmental system, we are always one medical bill or car accident or job loss away from disaster.

The current administration is actively loosening many of the protections around interest and credit. Unfortunately things could get even worse.